Digital Asset Exchanges are the central services through which you’re able to trade or “invest” into “crypto” systems. They provide a safe, secure and manageable system through which you’re able to buy “crypto” tokens from other people…

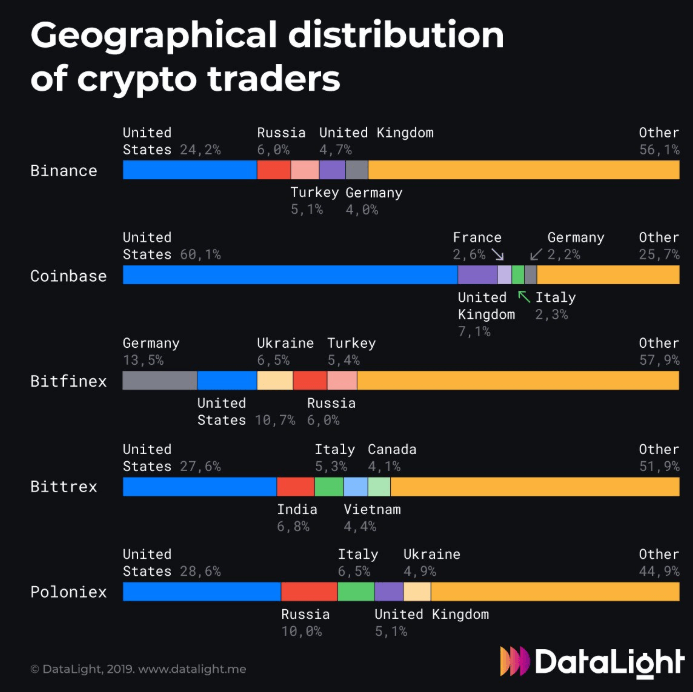

There are a large number of “crypto” exchanges – with CoinBase being the most popular by far. This exchange also allegedly recorded revenues of just over $1bn last year (2017), due primarily to the massive influx of retail traders buying up the various “crypto” tokens. Whilst each “crypto” service has its own quirks, the most common traits are that they will typically only provision the trade of “Bitcoin” for “fiat” currency. Most systems will not touch “alt” coins because they have such low values, and such volatile prices.

To this end, two types of exchange have grown – fiat/crypto and crypto/crypto.

The likes of Binance – for example – give you the ability to trade crypto/crypto, not permitting any fiat transactions at all. Therefore, if you wanted to buy “Litecoin” or something, you typically have to buy Bitcoin through the likes of CoinBase, and then transfer the BTC into Litecoin via Binance.

Unlike traditional “currency” exchange services, the “crypto” exchanges do not handle the currencies directly. Whilst it’s true that they will store the tokens in their infrastructure, it’s almost always the case that they will actually just act as a “wallet” for you – meaning that when they find a buyer, they trigger the sending process without you having to do anything.

[wp-stealth-ads rows=”2″ mobile-rows=”3″]

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc